Wage Loss Replacement Plan: A Comprehensive Solution for High-Income Employees

When it comes to protecting your team, especially your top executives, a standard group disability plan might not always be enough. This is where a Wage Loss Replacement Plan (WLRP) steps in. Think of it as an extra layer of financial protection, specifically designed for high-income earners and key personnel within your company. Let’s dive into why a Wage Loss Replacement Plan (or WLRP) could be exactly what your executives need to feel secure.

Why Should You Consider a Wage Loss Replacement Plan?

Ask yourself this: Are your executives adequately covered if they can’t work due to a disability? For many high-income earners, the answer is no. A typical group disability plan will cover a basic percentage of income, but for someone who relies on a substantial salary, this might not be enough to maintain their lifestyle. Imagine the stress of trying to pay bills, mortgages, and other expenses on a fraction of their income—it’s a real dilemma for many high-income earners who have been faced with a disability.

This is where a WLRP steps in, bridging the gap and helping to ensure that your key employees have the financial protection they need.

What Makes a Wage Loss Replacement Plan Stand Out?

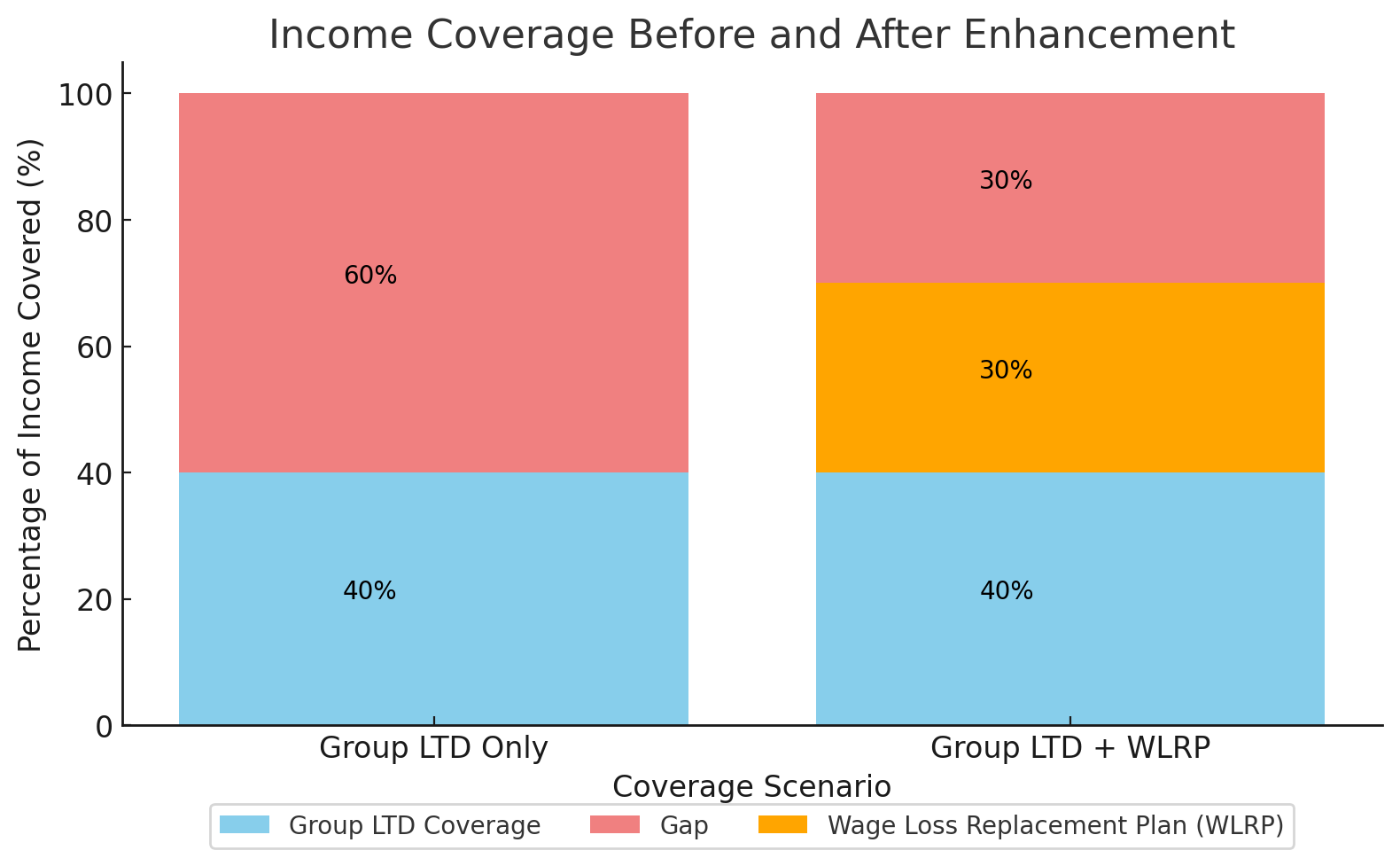

- Extra Income Protection: Think of a WLRP as a top-up to your regular disability plan. For example, a standard group LTD plan may only cover a fraction of an executive’s income due to plan design limitations. To address this, WLRPs can provide an additional layer of coverage to ensure that your executives can maintain their standard of living, even if they are unable to work for an extended period.

- Tax Efficiency and Adjusted Coverage: With a WLRP, benefits are typically taxable, as the employer pays the premiums. To address this, WLRPs allow employees to obtain a higher amount of coverage, ensuring that even after taxes, they receive adequate income replacement. This structure helps employees maintain their standard of living, even when the benefits are subject to taxation. Premiums are tax-deductible as a business expense, making this approach less expensive than increasing the employee’s salary to pay the premiums personally.

- Customizable Plans: Every company is different, and so are its needs. A WLRP isn’t a one-size-fits-all solution. You can choose which classes of employees will receive this coverage, and each class can have a different amount of coverage. Discounts are available when implementing a WLRP for three or more employees.

- Attracting and Retaining Top Talent: Offering a WLRP isn’t just about protecting employees; it’s also about protecting your business. By providing comprehensive coverage, you show your top talent that you value their contribution and care about their well-being. This can help you attract and retain the best people, enhancing loyalty and job satisfaction.

How Does a Wage Loss Replacement Plan Work?

A WLRP works alongside your standard group disability plan. Imagine it like this: A group LTD plan is currently providing $5,000 of monthly coverage for an executive earning $250,000 per year. This represents roughly 40% of the executive’s after-tax income being protected. The company implements a WLRP, adding another 30%, taking it up to 70% of their after-tax income being protected. This combination ensures that your key employees aren’t left struggling financially if they become disabled.

Implementing a WLRP

Setting up a Wage Loss Replacement Plan (WLRP) involves strategic planning to ensure it aligns with your company’s overall benefits strategy. Here are some key considerations:

- Eligibility Criteria: Determine which employees will be eligible for the WLRP based on their income level and role within the company. This ensures that the plan provides coverage to those who need it most.

- Benefit Levels and Features: Decide on the percentage of income to be replaced and consider additional features, such as a cost-of-living adjustment.

- Coordination with Existing Plans: Ensure the WLRP integrates seamlessly with your current group disability plan, providing comprehensive and uninterrupted coverage.

Final Thoughts:

A Wage Loss Replacement Plan is more than just an add-on to your benefits package—it’s an important part of protecting your company’s most valuable assets: your people. By supplementing the coverage of a standard group disability plan, a WLRP ensures that your executives are fully protected in the event of a long-term disability.

For employers, offering a Wage Loss Replacement Plan can enhance your ability to attract and retain top talent while demonstrating a commitment to the financial well-being of your key personnel. For employees, it provides the peace of mind that comes with knowing their income is protected, allowing them to focus on their recovery without the added worry of financial instability.

In today’s world, the unexpected can happen at any time, and having that extra layer of security can provide the peace of mind your employees are looking for.

Ready to talk about how a Wage Loss Replacement Plan can benefit your team? Reach out to us at SecurePlan. We’re here to help you find the right solutions for your business and your people.