First thing first, IRP is not a product – it’s a concept/strategy. Universal Life Insurance is the product – so let’s talk about that first. Should mentioned that Universal Life is quite complex as there are many different components and ways to structure. I tried to keep this as simple as I can.

Universal Life has two buckets – one bucket being the insurance itself and the other bucket being an investment. This means that when you pay your monthly deposit into an insurance plan – a portion of that deposit goes towards the cost of the insurance and the remainder goes into an investment. Don’t confuse the cost of insurance with the deposit amount.

Bucket One: Cost of Insurance

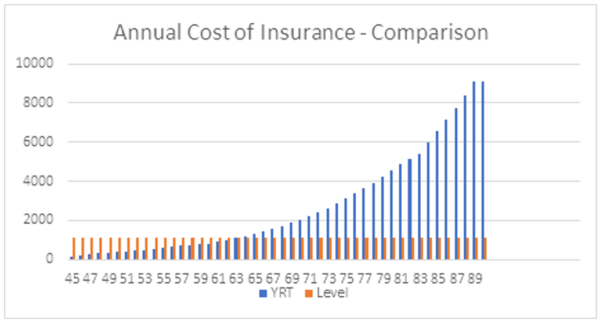

Many IRP strategies use an increasing cost of insurance, alternatively called Yearly Renewable Term. These can be very dangerous. What happens with these types of policies is that in the early years, the cost of insurance is extremely low, and in later years, the cost is extremely high. Let’s say someone is depositing $2,500 a year into their Universal Life plan. In the early years, the annual cost of insurance may only be $150, thus leaving $2,350 to go towards the investment account. However, in later years, the cost for this same policy would have significantly increased to over $9,000 per year. This means that the you are now using your investments to pay for the cost of insurance. What happens down the road if the “illustration” your advisor showed you didn’t perform as expected? It may easily mean that you run out of investments, and now you need to either cancel the policy or pay the high cost of insurance out of pocket. Instead, if permanent insurance is the right fit, you should consider a level cost of insurance. This means the cost is guaranteed to stay the same for life – no surprises.

Bucket Two: Investments

When it comes to investing inside of a Universal Life plan, you have options. There are several different funds that you can choose from, and you can choose an investment mix that meets your risk tolerance. Why would one want to invest inside of an insurance policy you may ask? The answer is the tax-deferred growth. Should mention, you would want to maximize your RRSP and TFSA first. However, for those that still have additional funds available for investing, they may want to consider a permanent policy over a taxable investment. This works even better if the investments are likely going to be left to a beneficiary or charity. This is because the investment will grow tax-free while the policy is effective and pay out tax-free to the beneficiary upon death of the insured. If the insured needs access to the money, they could withdraw the funds or borrow against the policy. The tax-savings that can come along with a permanent policy is what makes these attractive to high net-worth individuals, especially if they already have a need for permanent insurance to begin with.

Ok, So What’s the Difference Between Universal Life and Whole Life Insurance?

Both Universal Life and Whole Life can offer lifetime protection. Both can have a cash value and death benefit. The big difference between the two is flexibility. With Universal Life, you have the option where to invest your money and how much you want to invest. The actual investment component is separate, and will fluctuate with the market based on the funds you selected to invest in. In most cases, the investment value is paid out in addition to the original face amount (insurance amount) at time of claim.

Whole Life will automatically include an investment portion in the policy. Unlike Universal Life, you will not be able to choose how to invest this money. Typically, each year you will receive a dividend payment that will be used to buy additional coverage. This will increase your death benefit and cash value. Dividends are not guaranteed, however, there is a long history of dividends being paid each year. What is guaranteed in most contracts is that the insurer guarantees that you will never have a negative dividend, meaning the values can not decrease (they may just not go up as much if the dividend assumption doesn’t perform as anticipated).

What is an Insured Retirement Plan (IRP)?

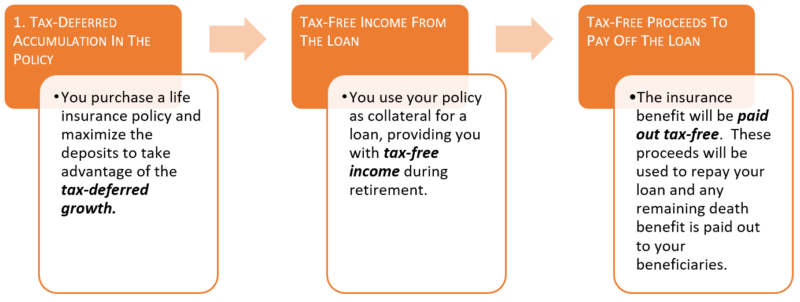

Simply, it’s a form of lending. More specifically, it’s a line of credit that allows one to access the cash value inside of their permanent policy. The advantage to this type of borrowing is that you can access cash from your permanent policy on a tax-free basis. Because one is not actually withdrawing funds from their cash value, the investment can also continue to grow tax-free inside their policy. In addition, the interest on the loan can be capitalized (added back into the loan) and paid back upon death.

The IRP concept/strategy that advisors are selling today are nothing more than illustrating how one can borrow against their policy down the road.

What’s the Process?

What’s the Risk?

What happens down the road if lending rules change?

As an example, I purchased an investment condo (pre-build) a few years ago. Since then, the mortgage rules have changed. Most lenders have introduced a stress test which significantly reduces my buying power. Back in 2016, I was able to qualify for a mortgage on this investment property without issue. Now that the rules have changed, I had to increase the income I pay to myself and leverage other assets to make this work. Luckily, I have other assets, or I may have been in a heap of trouble. While that has nothing to do with insurance, it is a reflection of how lending rules can change and how those changes can negatively impact an original plan.

With an IRP, my biggest fear is around the lending. Who knows what can change over time, and typically these are being purchased today to borrow against 20+ years down the road. What if they don’t allow you to borrow up to 75% or 90% anymore? What if the cost of borrowing goes way up? What happens if the bank calls the loan? What if CRA changes regulation? What if the client doesn’t have a good credit rating down the road?

What’s the Worse Case Scenario?

Illustrations are full of assumptions, and the values illustrated are based on these assumptions. Here’s the thing with assumptions – they rarely perform exactly as illustrated.

What happens if the investment inside the policy didn’t perform as anticipated? What happens if the cost of borrowing significantly increases? Maybe you start making interest payments on the loan. Maybe you repay a portion of the loan or maybe you use additional collateral as security.

Worse case, if you are not able to come up with the funds to reduce your credit balance or provide additional collateral as security – the bank can call the loan. If this happens, the client will have a limited amount of time to reduce their credit balance. If they fail in doing so, the bank can force the client to surrender their life insurance policy. This would be bad as it would trigger a significant tax liability. The policy proceeds at time of surrender may not be enough to cover the loan and tax liability. It’s critical that you understand when a lender is entitled to demand payment of the loan and what that may mean to you.

Who Should Consider an IRP?

Personally, I like IRPs for someone with an insurance need and already maxing out their RRSP and TFSA. In fact, the clients who truly are a good fit don’t care if the rules change. They are not relying solely on this for their retirement income. They are just looking to take advantage of the rules as they exist today to minimize taxation and are in a likely position of transferring wealth to the next generation or charity.

Here is a good article I have found online regarding IRP’s as well:

https://insurance-journal.ca/article/insured-retirement-plans-maximizing-the-high-net-worth-clients-financial-future/

By Jeff Romansky

CHS, CPCA Principal, SecurePlan Insurance Solutions

www.secureplan.ca

Jeff started his insurance career in 2006 when he joined RBC Insurance. During this time, he helped hundreds of insurance advisors grow their business by providing them with comprehensive advice, consultation and training. His commitment to building strong relationships, paired with his positive attitude and specialized expertise led him to win multiple awards including being #1 in his position throughout Canada on numerous occasions.

After nine successful years at RBC Insurance, he decided to pursue his dream and start his firm to help professionals, executives and owner-managed businesses with their individual insurance and employee benefits. Jeff proudly serves clients throughout Southwestern Ontario and the GTA.

Jeff Romansky is a broker, so you can be confident that he is working for you and not the insurance company. He consultative approach is welcomed by his clients as they never feel pressured and are always correctly informed. When necessary, Jeff will work with or bring in trusted partners to meet your overall financial goals. He is committed to building long-term relationships with all his clients and viewed as a trusted partner to many.

Jeff’ resides in Grimsby with his wife and daughter. When Jeff isn’t hard at work, you can find him with friends on the golf course, curling rink or camping with his family.