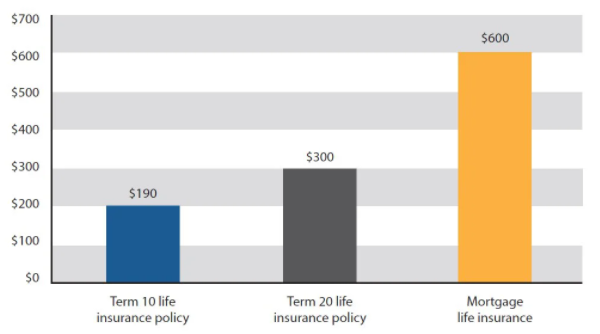

Did you know that you would likely be better off with an individual life insurance policy instead of taking bank mortgage insurance? There is a lot of public information out there that really sheds light on this fact. Simply, an individual plan can typically provide one with better quality coverage for less money.

Did you know that mortgage life insurance is OPTIONAL? I have heard countless times from clients that they thought that had to purchase the coverage when they secured their mortgage. That simply is not true.

CLICK HERE if you want to learn more and see what the media says about Mortgage Life Insurance (hint: they don’t like it!)

If you’re interested in having a no-obligations phone call with me to see how I can help you, here is a link to my Online Calendar:

Mortgage Life Insurance

15 years in the business and it still surprises me how many people don’t realize there is better and more affordable coverage when it comes to creditor insurance.

Personally, I have lost count of how many times a client told me that it was “required” to purchase life insurance with their mortgage – which is not the case, it is optional. Just the other day, someone thought they had to spend $400 a month on the creditor life insurance, and the bank didn’t even show them an option to purchase a mortgage without it. During my needs analysis, we decided that having the coverage wasn’t even necessary since she already had adequate coverage in place. Creditor Insurance is OPTIONAL, and if your lender tells you otherwise – they are not providing you with accurate information. You DO NOT need to take this insurance to be approved for a loan or activate your credit card. Still don’t believe me? Here is the proof, directly from the Government of Canada: (https://www.canada.ca/en/financial-consumer-agency/services/insurance/credit-loan.html#toc0)

What is Creditor Insurance?

Creditor Insurance is an optional insurance product that financial institutions can offer to help pay off credit or loans. Each lender may have different plans, however, they all offer Life Insurance that can cover a part or all of your debt in the event of a death. You may also be able to obtain Critical Illness or Disability protection as well, depending on the lender. While I agree that such protection is important for many, I don’t necessarily agree that Creditor Insurance is a great solution. In fact, I don’t know of any financial advisor that will say they recommend someone to go with creditor insurance, unless they are working for the lender. Here’s an article that can prove that statement and will share some of the disadvantages to such product: (https://globalnews.ca/news/3488311/mortgage-life-insurance-canada/).

Have you purchased, without knowing?

I have found that many clients didn’t even realize that they had or agreed to such coverage. On that note, I came across this decision from the Financial Consumer Agency of Canada (https://www.canada.ca/en/financial-consumer-agency/services/industry/commissioner-decisions/decision-138.html) and thought it would be beneficial to share such information. For those who are not in the insurance industry, they may not realize the disadvantages of going with creditor insurance. I would expand and share some of my thoughts about this decision based on the level of expertise in my field.

-

BMO sold 29,341 policies to their customers between Oct. 2014 and March 2017 – and that’s just one bank. There is so much opportunity for an insurance broker to help consumers make an informed decision and obtain better coverage through an individual policy. That being said, not all brokers are equal – so make sure you seek out one who is experienced and an expert in their field.

-

This issue is not just with BMO. In fact, it looks like they self-reported this and were cooperative and responsive to the FCAC’s investigation. I personally don’t believe the bank was intending to commit the violations, just a byproduct of such a transactional type of product that is often quickly sold during the process of obtaining a mortgage/loan. Another reason why working with a professional broker makes sense. One should invest the time to understand their options to protect one of their largest assets. If you have purchased creditor insurance, you are doing a disservice to yourself by not comparing it to what else is out there.

-

It’s important to note that banks are prevented to offer Individual Life Insurance through their branches, as it’s a breach of the Bank Act. This means that they are not able to help you explore all your options and creditor insurance is their solution to help someone get the coverage they need. If you need the coverage, it’s ok to take it with your mortgage and cancel it when you secure a better solution.

What is the BIGGEST RISK with Creditor Insurance?

These types of products typically only have a handful of “yes/no” questions and the client may be automatically disqualified for a claim if they accidentally answered a question incorrectly. Based on some of the questions, it’s fair that a consumer could have accidentally answered “no” simply because they didn’t understand the question. In addition, the mortgage broker or advisor selling the insurance is likely not qualified to provide advice, which is actually written on many of the applications. Not having someone that you can ask for their opinion, means that the answers you provided are your sole responsibility.

I don’t know about you but I want to have peace of mind that the coverage I purchased will be there for my family if something were to happen. Unfortunately, I do not have much confidence when it comes to simplified applications, such as creditor insurance. What’s my biggest concern? It’s called post-claim underwriting. The insurance company will try to determine if you answered the questions correctly, at the time of claim.

Here is an example of one question on the Mortgage Protection Plan Application:

“During the past 3 years have you had or been treated for: mental or nervous disorder (depression, anxiety, stress, etc.), neurological disorder including seizures, high blood pressure, kidney or urinary disorder, gastrointestinal bleeding, back or knee pain, arthritis, other musculoskeletal disorder or any other illness, disease, operation, injury, or congenital defect not listed?”

See the area in bold? ANY OTHER ILLNESS, no matter how insignificant it may have been could become an issue at the time of claim. This is the type of policy that gives the insurance industry a bad rap – that insurance companies do not pay out at the time of claim.

Okay, let’s expand on this a bit more… imagine someone experienced some migraines, and didn’t think too much about it and didn’t disclose. Down the road, they had a stroke and passed away. At the time of the claim, they found out that the client had a history of migraines, yet they answered “no” to all of the questions where they should have in fact answered “yes”. Are they going to pay? I wouldn’t want to be the insured’s family.

Imagine if this client decided to purchase a fully underwritten policy instead of creditor insurance. The application itself would ask about migraines giving the client the opportunity to disclose their medical history. If the underwriter needed additional information, they would have asked the client’s doctor for further details to help ensure full disclosure. Depending on the severity of the migraines, there is a good chance that the history of migraines itself would not have had an impact to a fully underwritten policy and would have been issued standard. Can you see the difference? Individual Insurance policies have a significantly higher payout ratio compared to creditor insurance.

If you, or someone you know, has creditor insurance that was purchased with their mortgage or loan. Please tell them to get a second opinion from an experienced broker. Not only does individual coverage offer a better contract, it’s typically much more affordable.

Still think Mortgage Life Insurance is a good idea? Here are a couple of really good videos to watch to learn more.

Hopefully this helps create a bit of awareness on the issue.